Eligible full-time employees will have the option to choose between the SISC Blue Shield HMO or PPO, or Kaiser Permanente HMO plans.

*PLEASE NOTE: If any information described on this site differs from the plan documents, the plan documents/SBCs will prevail.

Blue Shield of California

Access+ HMO Plan

The SISC Blue Shield HMO offers comprehensive health care by physicians and providers in the Access+ network only. You must select a primary care physician (PCP) within the network and see them first for all medical needs. The PCP will refer you to a specialist for any conditions that cannot be diagnosed or treated by the PCP. If your medical group or IPA (Independent Physician Association) is affiliated with the Blue Shield Access+ program, you are able to access a specialist within your medical group or IPA without seeing your PCP first or obtaining a referral, though you will pay a higher copay for self-referring through Access+.

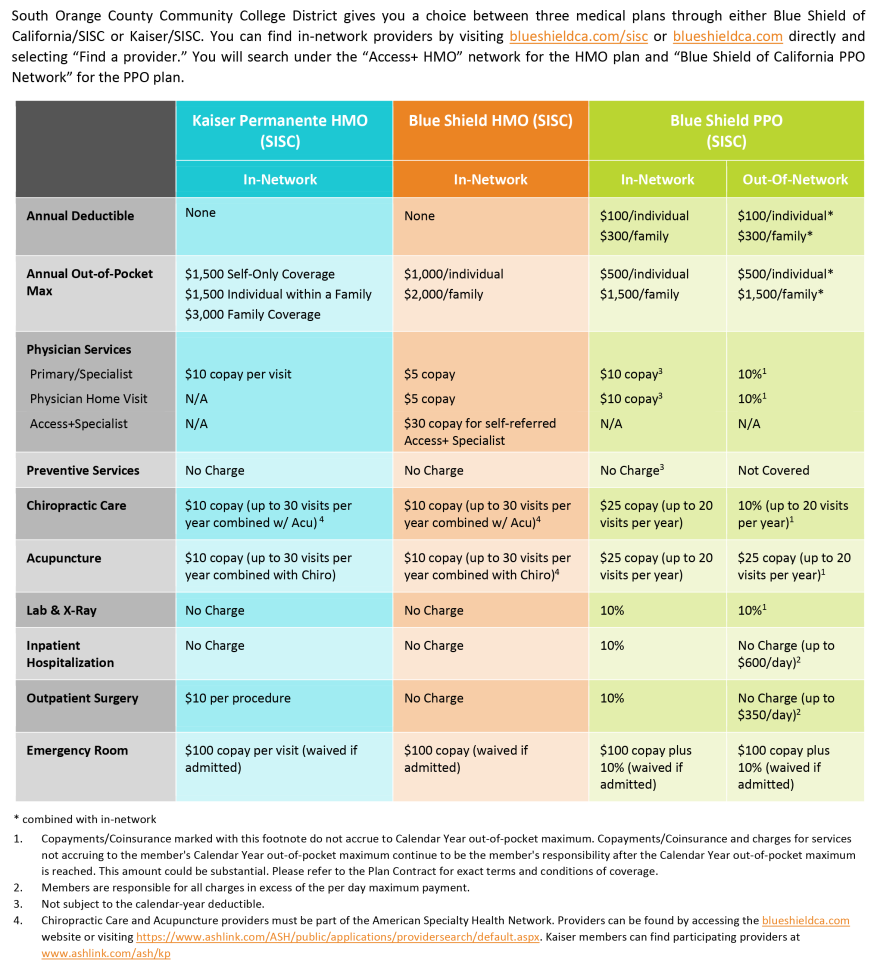

Some general plan details are below, or click on the Blue Shield HMO Plan Summary and Summary of Benefits and Coverage (SBC) for more information.

- No deductibles

- $5 office visit copay ($30 Access+ specialist copay)

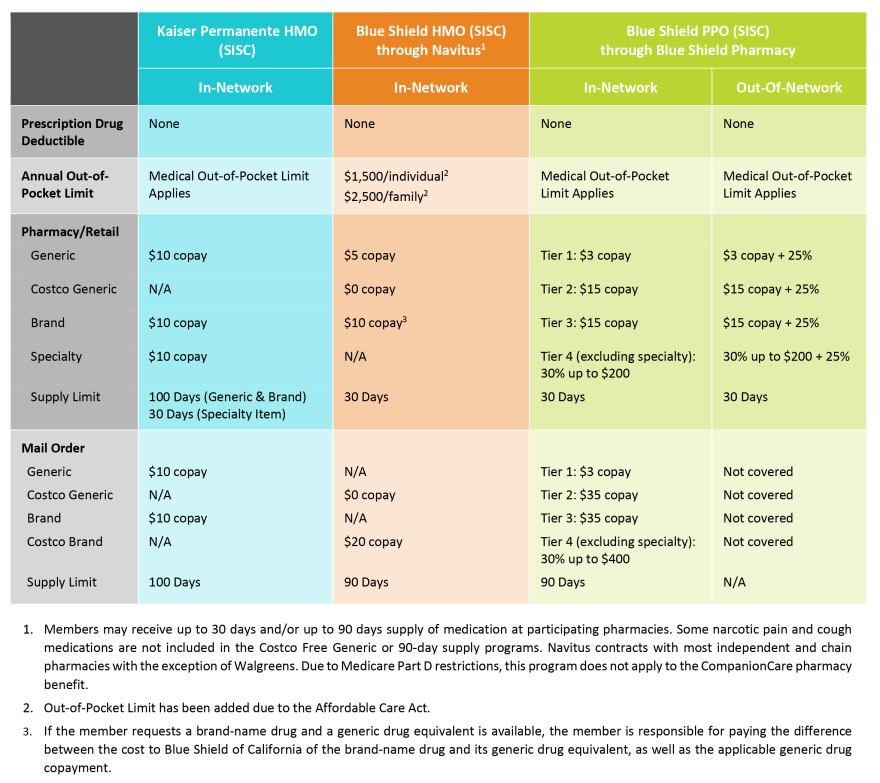

- Prescription drug benefit:

- Up to a 30 day supply through retail

- $5 generic

- $10 brand name at participating pharmacies

- Up to 90 day supply through mail service

- $0 generic

- $10 brand name

- 20% coinsurance, up to $100 maximum copay for specialty medication

- Up to a 30 day supply through retail

- Up to 30 chiropractic and/or acupuncture visits per calendar year, $10 copay

- Emergency room facility services are $100 per visit; emergency room physician visits are no charge

- Hospital and physician services are paid at 100%

- Primary care physician can be changed, but must be selected by the 15th of the month prior to your visit

- Annual copay calendar year maximum:

- $1000 per individual

- $2000 per family

- Unlimited lifetime maximum benefit

- Prescription Drugs

- If you enroll in medical coverage, you will automatically receive coverage for prescription drugs.

- Employees enrolled in the Blue Shield HMO plan will have prescription drug coverage through Navitus.

- If you are taking prescription medications on a regular basis, you may save time and money by using the mail service pharmacy.

Blue Shield Contact Information

- www.blueshiedca.com/sisc

- Blue Shield Customer Service Phone - (855) 599-2657

Navitus Prescription Drug Contact Information

- www.navitus.com

- Navitus Customer Service Phone - (866) 333-2757

Forms

- Visit SharePoint for all forms

Blue Shield of California

PPO Plan

Blue Shield of California PPO members can select doctors and hospitals within the PPO network, or they can pay more and go outside of the network for care. Unlike the HMO, you do not need to pre-select a primary care physician. You may see any physician in the preferred provider network. You do not need to be referred to see a specialist. Contracted doctors and hospitals in the preferred provider network render covered services to PPO plan members at contracted rates. Preferred providers will accept Blue Shield’s payment as payment in full after you cover the required deductibles, copayments and coinsurance amounts.

Out of network providers who have not contracted with Blue Shield to be part of the preferred provider network often charge members more than Blue Shield allowable amounts. You are responsible for the difference between the amount the non-preferred provider bills and any amount that Blue Shield pays. Some PPO plan benefits, such as certain preventive care and office visits, are not covered when accessed from a non-contracted provider.

Some general plan details are below, or click on the Blue Shield PPO Plan Summary and Summary of Benefits and Coverage (SBC) for more information.

- Annual calendar year deductible:

- $100 per individual

- $300 per family

- $10 office visit copay at in-network providers; 10% coinsurance at out-of-network providers

- Prescription drug benefit:

- Up to a 30 day supply through retail

- $5 generic prescriptions

- $10 brand name at participating pharmacies;

- Benefits at non-participating pharmacies are 25% of allowable amount plus copay

- Up to 90 day supply with Costco mail-order pharmacy

- $0 generic prescriptions

- $20 brand name

- 30% up to $150 max copay for specialty medication

- Up to a 30 day supply through retail

- Up to 20 chiropractic visits per calendar year at a $25 copay

- Up to 20 acupuncture visits per calendar year at a $25 copay

- Emergency room facility services are $100 copay; emergency room physician visits are 10% coinsurance

- Hospital services are 10% coinsurance; non-preferred hospital services are 10% copay up to $600 per day maximum payment

- Annual copay calendar year maximum:

- $400 per individual

- $1200 per family

- No Lifetime maximum benefit

- Prescription Drugs

- Employees enrolled in the Blue Shield PPO plan will have prescription drug coverage through Blue Shield Pharmacy.

- Please note: Prior authorization is required for specialty medications, including self-administered injectables.

- Navitus is Blue Shield’s exclusive Network Specialty Pharmacy and offers the convenience of home delivery or pickup.

Accessing Services When Traveling Outside of California: BlueCard Out of State

If you’re a PPO member, you may use the BlueCard Program for access to covered medical benefits. You and your enrolled dependents may access these PPO benefits when you’re traveling or temporarily living outside your home state with the BlueCard program. The BlueCard also covers enrolled dependents, including students and family members, who temporarily reside outside your home state. To locate BlueCard providers, call BlueCard Access® at 800-810-BLUE (2583) or call collect at 804- 673-1177.

- Call your Blue Cross Blue Shield Plan.

- Visit www.bcbsglobalcore.com

- Call the Blue Cross Blue Shield Global Core HMO plan members have coverage for emergency and urgent care services, or authorized medical follow-up care, when they are out of their HMO service area.

Condition Management

Condition Management is a program for PPO plan participants and designed to help people with specific conditions stay as healthy as possible for as long as possible. This program is confidential, voluntary and at no cost to you. Health management nurses work with you over the phone who are living with Diabetes or Coronary Artery Disease (CAD). For more information, call (866) 954-4567.

SISC Blue Shield Maven Maternity Care Benefit

SISC is providing Blue Shield PPO Members with free access to Maven Virtual Care – a 24/7 virtual access to one-on-one maternity and postpartum support. Members are matched with a Care Advocate who assist with birth planning, midwives, OB-GYNs, prenatal nutritionists, back-to-work support, and more!

Blue Shield Contact Information

- www.blueshiedca.com/sisc

- Blue Shield Customer Service Phone - (855) 599-2650

- Navitus

- navitus.com

- (866) 333-2757

- Costco mail-order pharmacy

- (800) 607-6861

- Costco.com/pharmacy

- You may also call the customer service phone number listed on your Blue Shield ID card for additional details

Forms

- Visit SharePoint for all related forms

Kaiser Permanente

HMO Plan

Kaiser Permanente HMO members can choose their own doctor, and that doctor coordinates your care with specialist as needed. You can select one doctor for your whole family or a different doctor for each family member. You can also change your doctor at any time. Your doctor, nurses, and other specialists work together as a team, sharing information to give you the care you need. They're connected to each other, and to you, through your electronic health record. They know your medical history, test results, medications, and allergies. So you get personalized care.

Get the care you need to get and stay healthy. From preventive screenings to care for serious conditions, Kaiser Permanente believes prevention plays a vital role in health care. To catch problems early, they offer preventive screenings, routine appointments, and more. Your electronic health records plays a key role in this, tracking services you get and reminding your doctor when you're due for care. You choose how you connect to care in person, by phone, by email or by video. Get the right care for any situation, emergency care, urgent care, specialty care, 24/7 nurse advice, or travel care. It's easy to get the care you and your family need. There are many Kaiser Permanente facilities in your area, offering convenient hours and a wide range of care and services. Many locations offer same-day, next day, after hours, and weekend services, along with ob-gyn, pediatrics, and other specialty departments. Most of the facilities offer a variety of care and services, so you can take care of several health care needs in one visit and without leaving the building.

Some general plan details are below, or click on the Kaiser HMO Plan Summary and Summary of Benefits and Coverage (SBC) for more information.

-

Annual calendar year deductible: None

-

$10 office visit copay (most primary care visits and most physician specialist visits)

- Prescription drug benefit:

- Most generic and brand-name items at a Plan Pharmacy or through mail-order service at $10 copay for up to a 100-day supply

- Most specialty items at a Plan Pharmacy at $10 copay for up to a 30-day supply

- Up to 30 chiropractic and /or acupuncture visits per calendar year at $10 copay

- Emergency room facility services are $100 per visit; emergency room physician visits are no charge

- Hospital and physician services are paid at 100%

- Annual copay calendar year maximum:

- $1500 per individual

- $3000 per family

- No Lifetime maximum benefit

Kaiser Permanente Contact Information

- www.kp.org

- Kaiser Permanente Customer Service Phone - (800) 464-4000

Forms

- Visit SharePoint for all related forms

Medical Plan Comparison

Making Medical Plan Changes

To make changes to your medical plan, including address or name changes, adding or deleting dependents, etc.

- Complete the following form: SISC Change Form

- Submit it to the Employee Benefits department

- If making a change due to a qualifying event such as marriage, divorce, birth of a child, etc., please make sure you submit your change form within 30 days of the qualifying event date

Medical Insurance Terms & Definitions

Deductible

The deductible is the amount that you must pay before your plan's benefits such as copays and coinsurance begin to apply. Most out-of-pocket costs that you pay for medical services will accumulate throughout the year (plan year or calendar, depending on the plan) to make up the deductible. Deductibles do not always apply to all services; check your plan summary or SBC for details.

Copayment or Copay

A copay is the fixed amount that you pay for a covered service, usually at the time of service.

Coinsurance

Coinsurance is the percentage cost share between the insurance carrier and a member.

Copay Maximum or Out of Pocket Maximum

The copay maximum is the most that you will pay out of your own pocket for the year (either plan year or calendar year). Costs that you pay accumulate throughout the year (plan year or calendar, depending on the plan) to make up the out-of-pocket maximum. Once the out of pocket maximum is reached, the insurance company will pay 100% of the allowed amount.

In-Network

A network is a list of providers that have agreed to participate with the health insurance company and have agreed to accept certain "allowed amounts" for services.

Out-of-Network

Providers who are not contracted and have not agreed to participate or accept "allowed amounts" for services. When using a non-network provider, any charges billed to the insurance carrier that exceed the allowed amounts, will be billed to you (see balance billing). You will generally pay more for out-of-network providers.

Allowable Charge

The negotiated amount that in-network providers have agreed to accept as full payment. Also, the maximum amount that the insurance carrier will pay for a service, sometimes known as "allowed amount" or "negotiated rate." If your provider charges more than the allowable charge, you may have to pay the difference (called balance billing).

Balance Billing

When an out-of-network provider bills a member for charges that exceed the plan's allowable charge. For example: If the total cost of services billed by the non-network provider is $100 and the allowable charge is $60, you may then be balance billed (charged) for the remaining $40.

Explanation of Benefits

The statement you receive from the insurance carrier that details how much the provider billed, how much the plan paid (if any) and how much you owe (if any). In general, you should not pay your provider until you have received this statement.

Dispense as Written (DAW)

A prescription that does not allow for substitution of an equivalent generic or similar brand drug.