Regular visits to your dentists can help more than protect your smile; they can help protect your health. Recent studies have linked gum disease to damage elsewhere in the body and dentists are able to screen for oral symptoms of many other diseases including cancer, diabetes and heart disease. SOCCCD provides employees with comprehensive dental coverage through Delta Dental of California/ACSIG.

*PLEASE NOTE: If any information described on this site differs from the plan documents, the plan documents will prevail.

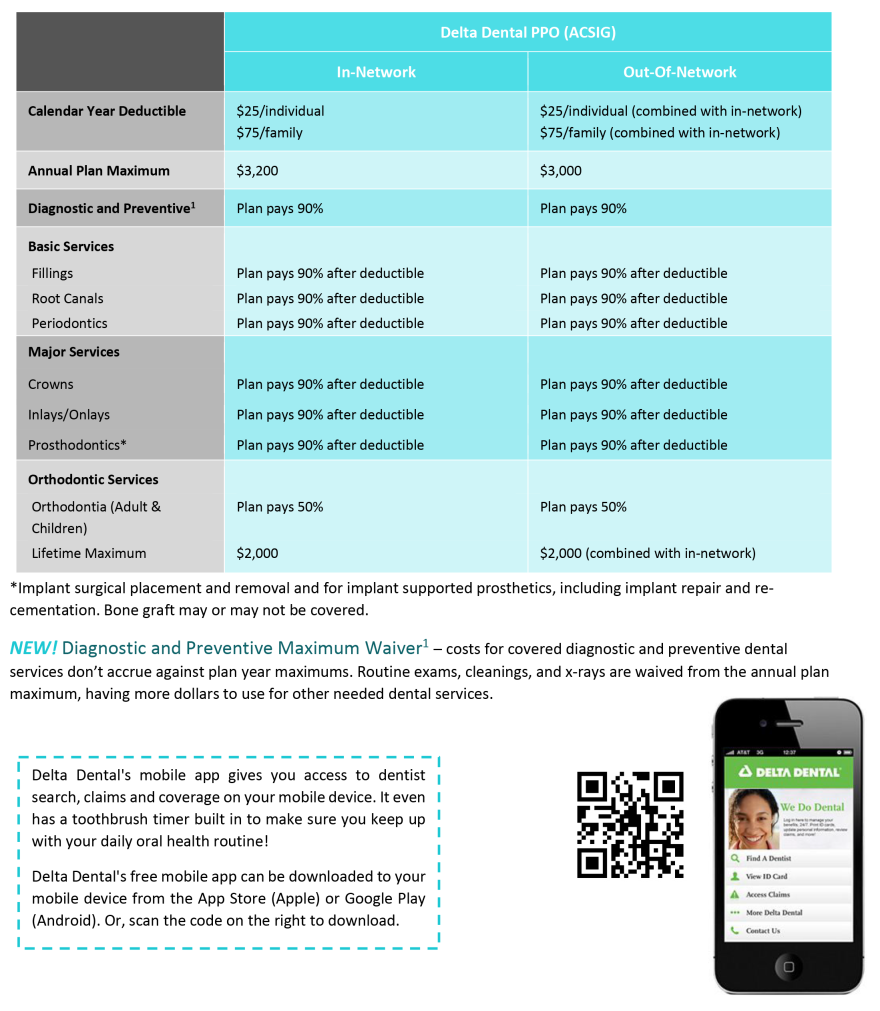

Delta Dental PPO

When visiting a PPO dentist, you typically pay a percentage of the reduced rate for services and the plan pays the rest. Although the levels of coinsurance percentages are the same no matter what dentist you choose, out-of-pocket expenses may differ if you choose a non-network dentist.

The Delta Dental website features a directory of providers by geographic location and specialty, as well as oral health and wellness information. You can create an account and access your identification card, view eligibility and benefits, and find average fees charged by dentists. During the registration process you have the option of "going green" and receiving your claims online only.

The plan covers three cleanings per year and one deep cleaning every two years. Members are eligible for dental implant coverage.

Some general plan details are below, or click on the Delta Dental PPO Plan Summary for more information.

Visit SharePoint for a full plan description

Delta Dental Contact Information

(866) 499-3001

Making Dental Plan Changes

To make changes to your dental plan, including address or name changes, adding or deleting dependents, etc.

- Complete the following form:

- Submit it to the Employee Benefits department

- If making a change due to a qualifying event such as marriage, divorce, birth of a child, etc., please make sure you submit your change form within 30 days of the qualifying event date

Dental Insurance Terms & Definitions

DEDUCTIBLE

The deductible is the amount that you must pay before your plan's benefits such as copays and coinsurance begin to apply. Most out-of-pocket costs that you pay for dental services will accumulate throughout the year (plan year or calendar, depending on the plan) to make up the deductible. Deductibles do not always apply to all services; check your plan summary for details.

Copayment or Copay

A copay is the fixed amount that you pay for a covered service, usually at the time of service.

Coinsurance

Coinsurance is the percentage cost share between the insurance carrier and a member.

ANNUAL MAXIMUM

Unlike a medical annual maximum, the dental annual maximum is the most that THE PLAN will pay for the year (either plan year or calendar year). Covered costs for services that you receive accumulate throughout the year (plan year or calendar, depending on the plan) to make up the annual maximum. Once the maximum is reached, the insurance company will no longer pay for services for the year (plan year or calendar year, depending on the plan).

IN-NETWORK

A network is a list of providers that have agreed to participate with the dental insurance company and have agreed to accept certain "allowed amounts" for services.

OUT-OF-NETWORK

Providers who are not contracted and have not agreed to participate or accept "allowed amounts" for services. When using a non-network provider, any charges billed to the insurance carrier that exceed the allowed amounts, will be billed to you (see balance billing). You will generally pay more for out-of-network providers.

Allowable Charge

The negotiated amount that in-network providers have agreed to accept as full payment. Also, the maximum amount that the insurance carrier will pay for a service, sometimes known as "allowed amount" or "negotiated rate." If your provider charges more than the allowable charge, you may have to pay the difference (called balance billing).

Balance Billing

When an out-of-network provider bills a member for charges that exceed the plan's allowable charge. For example: If the total cost of services billed by the non-network provider is $100 and the allowable charge is $60, you may then be balance billed (charged) for the remaining $40.